Market Commentary - 10.15.14 Flight to QualityThe benchmark 10 year U.S. Treasury yield fell from 2.2% to as low as 1.858% on Wednesday morning. The move was quick and sharp and the yield had already recovered in less time than it might take to finish a cup of morning coffee. The yield subsequently rebounded back to approximately 2%, but the dramatic drop is a good reminder of how difficult it can be to forecast interest rates and how quickly the market can turn. While many predicted a rise in rates going into 2014, the 10 year Treasury has actually fallen 33% this year from 3% to 2%.

Yields, which move inversely with prices, have been falling due to decreasing supply and increasing demand dynamics as well as increasing geopolitical risks in the Ukraine and Middle East. Decreased government spending has helped to decrease the federal deficit, so fewer bonds are being issued and there are fewer bonds to buy, even as the Fed is exiting their bond buying program known as Quantitative Easing or “QE.â€쳌 In addition, demand for bonds from institutional investors and countries like China has been strong. Foreign currencies are expected to fall relative to the US dollar making Uncle Sam’s bonds even more attractive to foreign investors. Today’s Treasury rally was in reaction to a disappointing retail sales report and a decline in an inflation reading which sparked concerns that growth may be slowing.

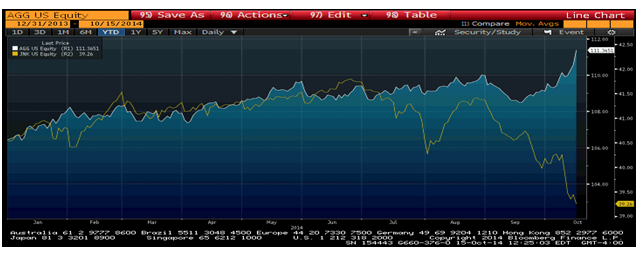

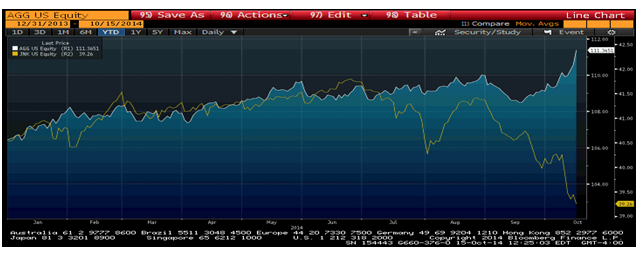

Credit spreads also widened dramatically this morning. The spread of the junk bond index over Treasuries started the summer below 300 basis points has increased to over 500 basis points. The widening credit spread recalls memories of a quote from a veteran financial newsletter writer, Raymond Devoe, Jr., who recently passed away on September 27th. “More money has been lost reaching for yield than at the point of a gun.â€쳌 While this may be a bit dramatic, one can see from the chart below, high yield bonds are down roughly 3% year-to-date while high quality bonds are up almost 4%.

This may actually have created a buying opportunity for high yield bonds which are, by no means, inherently a bad investment. The divergence simply highlights the differences between high-quality bonds and higher-yielding bonds. It is important to remember why one should own bonds and what role they play in an investor’s portfolio. Higher-yielding bonds are going to have a higher correlation to equities than higher-quality bonds. If one is looking for a non-correlated asset class to buffer equity exposure, high-quality bonds and duration risk can be one of the best asset classes to use for this purpose. One has to weigh the duration risk and credit risk of their portfolio carefully.

While interest rates continue to defy the pundits, we believe it is still inevitable that rates will eventually rise in the near future. We feel that volatility will persist in the market as geopolitical risks remain and investors continue to be weary of the Fed’s next move. We continue to predict a gradual rise in rates, and as such, are recommending an underweight to interest rate risk, as measured by duration, and overweighting spread product. Keep in mind this is an underweight to duration, and we are not recommending investors eliminate interest rate risk in their portfolios. We feel the additional yield from spread product could cushion a portfolio against a rise in interest rates. The recent widening of spreads is a good lesson that this overweight to spread product should be maintained within a client’s risk tolerance. This information is compiled by Cetera Investment Management.

About Cetera Investment Management

Cetera Investment Management LLC provides passive and actively managed portfolios across five traditional risk tolerance profiles to the clients of financial advisors, who are affiliated with its family of broker-dealers and registered investment advisers. Cetera Investment Management is part of Cetera Financial Group, Inc., which includes Cetera Advisors LLC, Cetera Advisor Networks LLC, Cetera Financial Specialists LLC, and Cetera Investment Services LLC.

About Cetera Financial Group

Cetera Financial Group, Inc. is the cornerstone of the retail advice division of RCS Capital Corporation (RCS Capital) (NYSE: RCAP), which is focused on serving the needs of investors with best-in-class solutions.

Committed to using its collective knowledge and expertise in service to and for others, Cetera Financial Group is focused on the growth of its affiliated broker-dealers and financial professionals’ businesses by giving them the industry and market insight, technology, resources and solutions they need to better focus on helping their clients pursue their financial goals. For more information, visit cetera.com.

No independent analysis has been performed and the material should not be construed as investment advice. Investment decisions should not be based on this material since the information contained here is a singular update, and prudent investment decisions require the analysis of a much broader collection of facts and context. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. The opinions expressed are as of the date published and may change without notice. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision.

All economic and performance information is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot directly invest in unmanaged indices. Please consult your financial advisor for more information.

Additional risks are associated with international investing, such as currency fluctuations, political and economic instability, and differences in accounting standards.

Affiliates and subsidiaries and/or officers and employees of Cetera Financial Group or Cetera firms may from time to time acquire, hold or sell a position in the securities mentioned herein. |